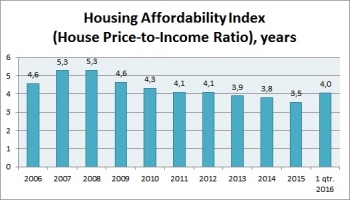

Despite the tightening of mortgage lending terms and a 35% drop in the volume of mortgage loans issued in 2015 down from the values reached in 2014, the national average values of HAI improved in Russia. In 2014, 29.6% of households had access to mortgage loans, while in 2015 the value reached 30.8% of households. If assessed in terms of house price to household income ratio the affordability of housing has also slightly improved. As of 2014, it took 3.8 years a household of 3 persons to accumulate all their incomes for a purchase of a standard dwelling, while in 2015 it took a household 3.5 years which means that, on average, they needed 3.6 months less.

Tatyana Polidi, IUE Executive Director, Real Estate Market Department:

On the face of it, this paradoxical result displayed against the backdrop of a decreasing sale-and-purchase market and dropping mortgage market may be accounted for by the following factors. With sustainable house price in nominal terms in the housing market (some regions demonstrate a reduction in house price), the average nominal income somewhat grows due to 30% of the households with the highest income. Hence a drop in average price to average income ratio, and also a better access to dwellings via mortgage loans for groups of people with the highest incomes. At the same time, nominal income of other groups is either sustainable or getting lower. This has a detrimental effect on housing affordability for 70% of the total population.

In the first quarter of 2016 a reduction in mortgage interest rates positively affected the affordability of housing. Along with this, the volumes of mortgage loans issued started to restore their positions.

In Russia, IUE regularly calculates Housing Affordability Indices and issues them as soon as the official data of Rosstat and Bank of Russia become available.